HMRC-Compliant VAT Returns for Users of Keyloop DMS

Still searching for an HMRC-compliant way to submit your dealership’s VAT returns?

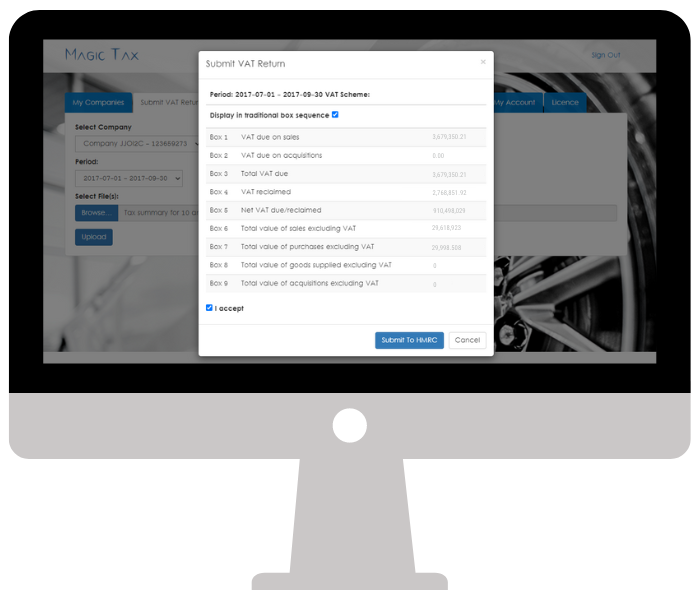

Magic Tax will save you time, remove the need for error-prone manual data entry or manipulation of spreadsheets and ensures compliance with HMRC‘s digital record-keeping and digital links regulations.

The solution becomes the digital link or ‘bridge’ between your DMS solution and HMRC‘s system, ingesting the VAT summary report file from your Keyloop system in the exact format in which it is extracted.

And the best bit? It’s available on a FREE 3-month trial* – with no obligation to pay for an annual licence and no credit card or payment details are required.

Free 3-Month Trial

Take advantage of a 3-month FREE trial and see how quick and easy filing a VAT return with Magic Tax can be.

FREE 3-month trial* – valid for 3 months or when one VAT submission has been filed with HMRC, whichever happens first.

The Magic Tax team are ready and willing to help streamline your MTD for VAT processes.

If you are interested in a demo of the solution?

Request one here:

Read more information about HMRC’s planned system downtime here.

If HMRC’s system is down, the Magic Tax solution will be too, as our solution relies on their system being operational.

Interested in KFA Connect?

Find out more about systems integration, bespoke software development, eCommerce Development & Integration, Business Process Automation and more…