HMRC-Compliant VAT Returns for Keyloop DMS Users

Are you still searching for a fast, easy, and HMRC-compliant way to submit your dealership’s VAT returns?

If you’re using Keyloop DMS, the answer is here, and it’s designed specifically with your needs in mind. Magic Tax offers a dedicated VAT filing bridging software solution developed exclusively for motor retailers using the Keyloop dealer management system.

It removes the hassle of manual spreadsheet work, ensures full compliance with HMRC’s Making Tax Digital (MTD) requirements, and helps finance teams save valuable time every VAT quarter.

Why Dealerships Choose Magic Tax

Submitting VAT returns through other methods can be time-consuming, error-prone, and stressful, especially under the strict digital record-keeping and linking regulations introduced by HMRC.

Many dealerships still rely on manual workarounds or disconnected tools that increase the risk of non-compliance.

Magic Tax changes all that…

✅ HMRC-recognised: Fully compliant with HMRC’s MTD for VAT standards

✅ Works with your VAT extract in the Keyloop format: No need to manually manipulate or reformat files

✅ No manual data entry: Eliminate common errors and spreadsheet fatigue

✅ Secure & simple: Designed with dealership workflows in mind

A Purpose-Built Digital Bridge for Keyloop Users

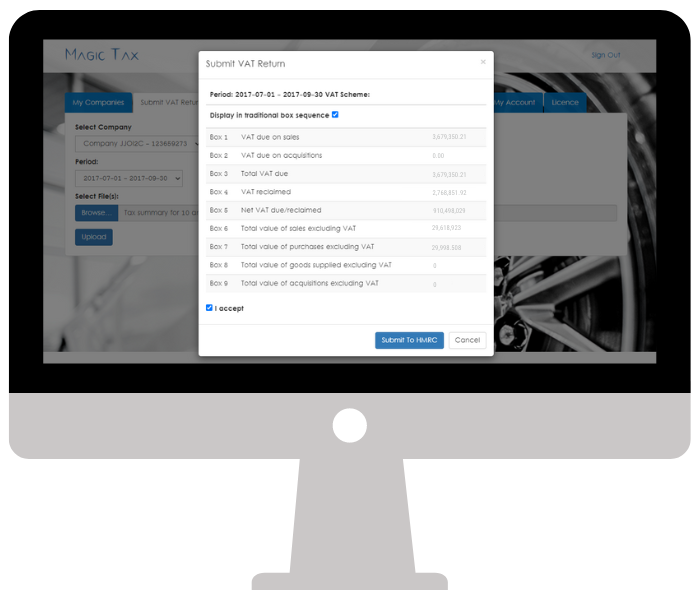

Magic Tax acts as a secure digital bridge between your Keyloop DMS and HMRC’s systems.

It’s capable of ingesting your VAT summary report file in its original format, meaning no conversion, no reformatting or manual manipulation, and no risk of breaking HMRC’s digital link and digital record-keeping regulations.

You simply extract your VAT summary from Keyloop, upload it into Magic Tax, and the system handles the rest, guiding you step by step through a simple, intuitive submission process.

It’s compliance – made effortless.

Want a closer look?

See It for Yourself with 3 Months Free

And the best bit? It’s available on a FREE 3-month trial.

To help dealerships experience the simplicity and power of Magic Tax, we’re offering a completely free 3-month trial*, with no credit card required and no obligation to continue with a paid-for subscription.

The free 3-month trial includes:

- Full access to the platform

- One VAT submission to HMRC

- No licence commitment

- No payment details required

You can register, upload your data, and submit a VAT return with full HMRC compliance, all at zero cost.

Take advantage of a 3-month FREE trial and see how quick and easy filing a VAT return with Magic Tax can be.

Magic Tax — Built for Motor Retail. Trusted by Dealerships. Recognised by HMRC.

Ready to Simplify VAT Returns?

Motor retailers across the UK are already using Magic Tax to streamline their VAT process, reduce admin headaches, and stay confidently compliant.

With an easy-to-use dashboard and a trusted reputation, Magic Tax is the smart choice for dealerships using Keyloop.

*The trial is valid for three months or until your first successful VAT submission, whichever comes first.

The Magic Tax team are ready and willing to help streamline your MTD for VAT processes.

If you are interested in a demo of the solution?

Request one here:

Read more information about HMRC’s planned system downtime here.

If HMRC’s system is down, the Magic Tax solution will be too, as our solution relies on their system being operational.

Interested in KFA Connect?

Find out more about systems integration, bespoke software development, eCommerce Development & Integration, Business Process Automation and more…