Let’s Talk About HMRC-Recognised VAT Compliance for Car, Van & Motorhome Dealerships

If you’re running a car, van, or motorhome dealership, you already know the VAT landscape feels more like an obstacle course than a straight road.

Retail margins, part-exchange, accessories, service departments – every piece adds complexity. And when it comes to submitting VAT to HMRC, the last thing you want is uncertainty.

That’s exactly why 2026 is the perfect moment to tighten up your VAT process and make compliance effortless. And yes, there is a way for Keyloop users to do that without spreadsheets, manual copy/paste, or risky workarounds.

Let’s talk about the big one: HMRC-recognised VAT compliance.

Dealerships using Keyloop (Previously CDK / Kerridge) Drive & Autoline often ask us the same questions:

“Is there a simple way to stay compliant?”

“Should I really be exporting and manipulating data every quarter?”

“Is there something that actually integrates properly?”

Magic Tax was built to answer those questions with a confident Yes!

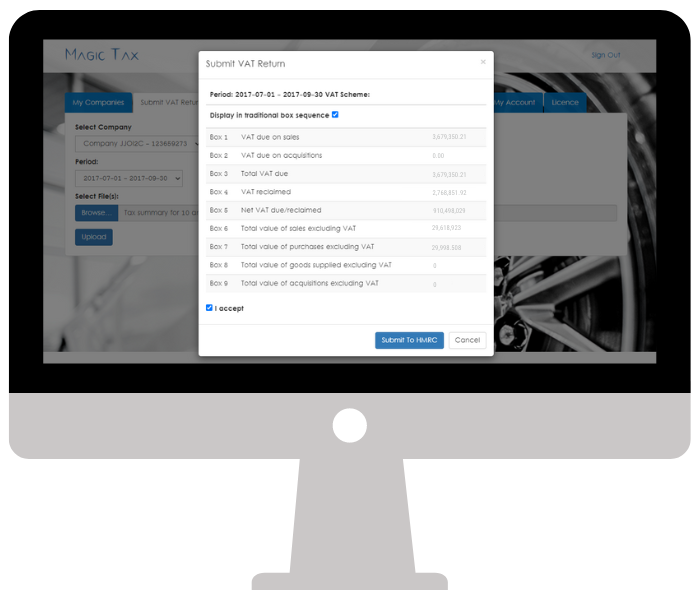

Magic Tax is HMRC-recognised, meaning it meets the strict digital link / digital record-keeping requirements of HMRC’s Making Tax Digital (MTD) legislation. Even better, it connects directly to HMRC’s system – no copy/paste, no manual file tweaking, no reformatting, and with a full audit trail.

In other words: your data stays clean, compliant, and exactly where HMRC wants it to be.

Why dealership VAT needs extra attention

Car, van, and motorhome retailers face some unique VAT challenges:

✅ Multiple revenue streams

✅ Retail schemes and margin schemes

✅ Manufacturer bonuses and incentives

✅ Complex transactions involving part-exchanges

✅ Large, frequent stock movements

✅ Deposit Movements between obligation periods

✅ Fuel-Scale Charges

✅ Postponed Import VAT Accounting (PVA)

This is not the place for manual intervention, “adjusting” numbers in spreadsheets, or crossing your fingers that HMRC won’t look too closely.

Magic Tax keeps everything connected directly from Keyloop to HMRC – digitally, securely, and in full compliance with MTD rules.

A Smoother, Faster VAT Quarter

Instead of last-minute stress, imagine this:

✅ Your Keyloop data flows straight into Magic Tax

✅ You review it in a clean, friendly interface

✅ You submit to HMRC with a click

✅ You know, without doubt, you are compliant

That’s why dealerships across the UK are making the switch: because VAT shouldn’t be a quarterly headache.

Try it yourself – with a 3-month free trial

To help dealerships start 2026 fully compliant, Magic Tax is offering a 3-month free trial* – long enough to complete one VAT submission at no cost, and no payment details are required.

This allows you to:

✅ See how easy it is

✅ Run in tandem with your current process

✅ Check exactly how it fits your workflow

✅ Experience the simplicity

✅ Test compliance with real data

✅ Train your team at zero risk

Once you’ve made that first submission, you’ll know instantly whether Magic Tax is the right fit (spoiler alert: it probably will be!).

Start 2026 the right way: compliant, confident, and stress-free

If VAT submissions take too long…

If you’re worried about compliance…

If you’re tired of complicated manual manipulation of data…

Start your free trial today and discover how user-friendly, quick, and effortless VAT management can be for dealerships using Keyloop.

2026 is approaching fast. Make this the year you move to a better, compliant, HMRC-recognised way to manage VAT.

*The trial is valid for three months or until your first successful VAT submission, whichever comes first.

Magic Tax — Built for Motor Retail. Trusted by Dealerships. Recognised by HMRC

Ready to Simplify VAT Returns?

Motor retailers across the UK are already using Magic Tax to streamline their VAT process, reduce admin headaches, and stay confidently compliant.

With an easy-to-use dashboard and a trusted reputation, Magic Tax is the smart choice for dealerships using Keyloop.

The Magic Tax team are ready and willing to help streamline your MTD for VAT processes.

Interested in a demo of the solution?

Request one here:

Read more information about HMRC’s planned system downtime here.

If HMRC’s system is down, the Magic Tax solution will be too, as the solution relies on HMRC’s system being operational.

Interested in KFA Connect?

Find out more about systems integration, software development & integration, eCommerce integration, business process automation and more…