The Benefits of Making Tax Digital (VAT) Bridging Software for Keyloop Users

As the world becomes increasingly digitalised, tax authorities worldwide are embracing technology to streamline tax compliance processes.

Value Added Tax (VAT) return filing in the UK, in particular, has undergone a significant transformation since 2019, transitioning from traditional paper-based methods to digital solutions.

In order to comply with HMRC regulations, businesses must maintain digital records and submit their returns using a digital link. This means not manually altering the data from the digital records held on the key business systems.

This poses an issue for businesses in the motor trade with a requirement to make necessary adjustments (such as fuel scale charges and the movement of deposits from one quarter to another) before submitting their VAT return – but still needing to comply with HMRC’s regulations.

One bridging software solution stands out as a perfect solution for Keyloop DMS users: Magic Tax.

In this blog post, we’ll delve into the world of Magic Tax, bridging software that has revolutionised the way Keyloop users file their VAT returns digitally.

Making Tax Digital

Before we tell you what Magic Tax really is, let’s understand why VAT return filing has gone digital. The move toward digitalisation aims to enhance efficiency, accuracy, and transparency in tax reporting. Traditional manual methods are not only against HMRC regulations but also often lead to errors, delays, and higher administrative burdens for businesses and tax authorities alike.

To address these challenges, tax authorities (including HMRC in the UK) have introduced Making Tax Digital (MTD) initiatives in various countries. MTD mandates businesses to keep digital records of their transactions and submit VAT returns using approved software. While this modernisation comes with its fair share of benefits, it also poses challenges for businesses that are not technologically equipped or require a user-friendly compliant solution, such as Keyloop users.

Magic Tax

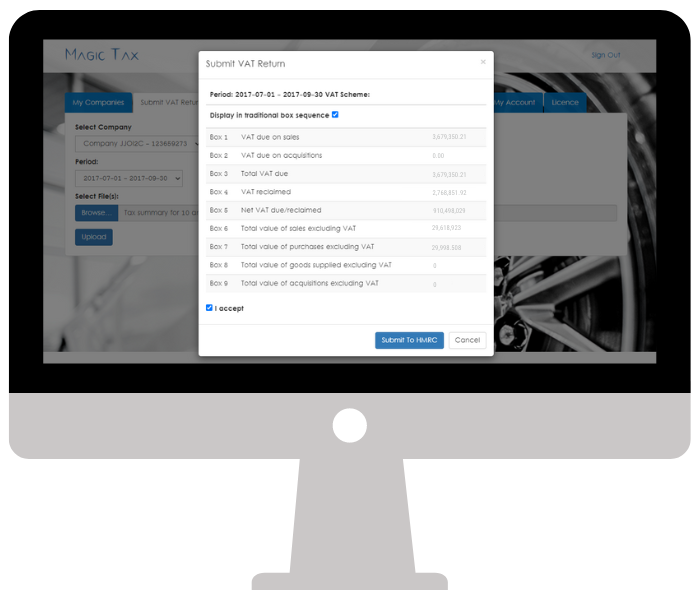

Magic Tax emerges as the answer to these challenges, presenting a seamless bridge between businesses and HMRC. As a bridging software solution, Magic Tax enables businesses to digitally submit VAT returns by ingesting the VAT Summary Report from the Keyloop system in the exact format in which it is extracted.

With its user-friendly interface and intuitive features, Magic Tax eliminates the complexities of digital VAT return filing.

Key Features and Benefits

Digital Link

Magic Tax uses HMRC’s API (Application Programming Interface) to seamlessly communicate digitally with their MTD for VAT system, ensuring a smooth transition from manual to digital filing processes. This integration minimises disruptions to existing workflows, allowing businesses to adapt to digitalisation effortlessly.

Automated Data Validation

Human errors are common when manually entering or manipulating data, leading to potential discrepancies in VAT return filings. Magic Tax automates data validation, ensuring accuracy and compliance with tax regulations. This feature significantly reduces the likelihood of errors and minimises the risk of penalties.

Time and Cost Savings

By streamlining the VAT return filing process, Magic Tax saves dealerships valuable time and resources. Manual data entry can be time-consuming and prone to delays, whereas Magic Tax accelerates the process, allowing businesses to focus on their core operations.

Secure and Compliant

Magic Tax adheres to the highest security standards, safeguarding sensitive financial information during transmission and storage. Additionally, the software is regularly updated to comply with changing tax regulations, ensuring that businesses remain compliant at all times.

Real-Time Insights

Magic Tax provides businesses with real-time insights into their VAT obligations from a user-friendly dashboard. With access to up-to-date financial data, including obligations, liabilities, payments and filing history businesses can make informed decisions and plan their financial strategies more effectively.

As tax authorities worldwide continue to embrace digital transformation, businesses must adapt to these changes to stay compliant and competitive. Magic Tax emerges as the ultimate solution for Keyloop customers, bridging the gap between the Keyloop DMS solution and digital VAT return filing.

Embrace the magic of technology and let Magic Tax lead the way to effortless VAT return filing, empowering your business with accuracy, efficiency, and compliance. Step into the future of VAT compliance with Magic Tax today.

Free 3-Month Trial

With a Free 3-Month free trial you can use the solution to see for yourself how it will benefit your business.

The Free trial is valid for 3 months or when you have made a submission – whichever comes first.

There is no obligation to sign up for an annual licence once the free trial expires, and no payment information is taken during the free trial period.

The Magic Tax team are ready and willing to help streamline your MTD for VAT processes.

If you are interested in a demo of the solution?

Request one here:

Read more information about HMRC’s planned system downtime here.

If HMRC’s system is down, the Magic Tax solution will be too, as our solution relies on their system being operational.

Interested in KFA Connect?

Find out more about systems integration, bespoke software development, eCommerce Development & Integration, Business Process Automation and more…