The Benefits of Making Tax Digital (VAT) Bridging Software

Making Tax Digital (MTD) VAT Bridging Software offers several numerous benefits for businesses needing to comply with the UK government’s MTD initiative for submitting VAT returns digitally.

Compliance with MTD

Making Tax Digital (VAT) is now mandatory – having now been rolled out to all VAT-registered businesses from 1st November 2022.

By using Bridging Software, businesses can ensure they meet the digital submission requirements set by HM Revenue and Customs (HMRC).

The benefits of using MTD VAT bridging software include enhanced compliance with MTD regulations, streamlined data processing and automation, improved data accuracy, time efficiency, and the availability of an audit trail for thorough record-keeping.

Keyloop users can effortlessly comply with the UK government’s MTD (VAT) initiative, ensuring seamless submission of VAT returns with Magic Tax.

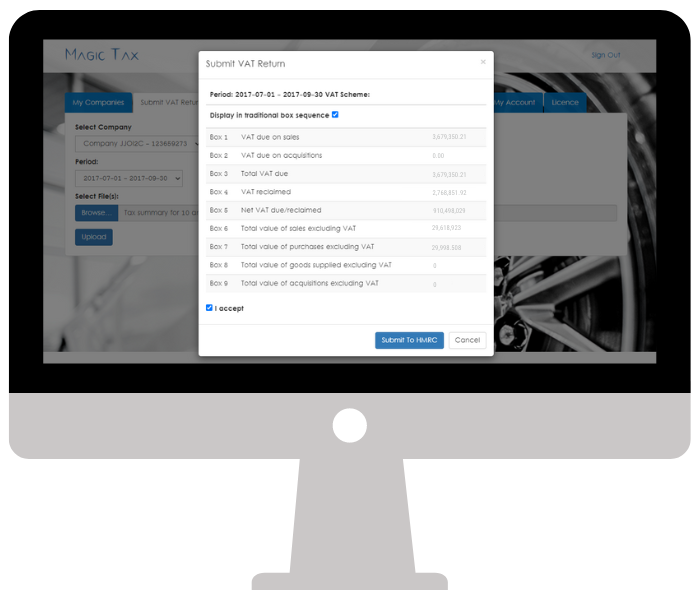

Magic Tax

Magic Tax is a bridging software solution which has been developed specifically for Keyloop users in the motor industry – transforming the way that these businesses handle their vat obligations.

Magic Tax uses the data from the VAT Summary Report file (in the exact format it is extracted from the Keyloop system).

The solution will calculate the VAT return for your business, based on the tax groups and tax codes you specify you would like included (from the data during the set-up process).

Magic Tax allows the user to check and then submit the return to HMRC quickly and easily. During this process, Magic Tax interacts directly with HMRC’s MTD (VAT) software system and provides the user with a confirmation number (generated by HMRC’s system) – so the user knows the return has been successfully received by HMRC.

Seamless Communication

Magic Tax communicates directly with HMRC’s system using an API (Application Programming Interface).

Magic Tax ‘calls’ information from HMRC’s system, such as Obligation periods, Liabilities and Filing History before the information is sent using the API to HMRC’s system during the ‘Submit a VAT Return’ process.

Streamlined Data Processing

Bridging Software can automate the process of extracting VAT data from your Keyloop VAT Summary File, eliminating the need for copy/paste, manual manipulation, manual calculations, and manual data entry. Magic Tax is compatible with Keyloop’s Drive and Autoline file formats and is capable of merging multiple files to calculate one VAT return.

The solution uses the relevant data from your Keyloop extract to calculate the VAT return which can then be sent digitally to HMRC, saving time, and eliminating manual input and associated errors.

Data Accuracy

Magic Tax helps maintain accurate VAT records by automating data processing and calculations.

It reduces the risk of human error associated with manual data entry and ensures accurate VAT figures are reported to HMRC based on your Keyloop system data.

Time Efficiency

Magic Tax ingests the VAT Summary File in the exact format as extracted from the Keyloop system, so saves time for businesses, allowing them to focus on other important aspects of their operations.

Filing History

The filing history feature from the dashboard provides an audit trail for submitted VAT returns.

Users can view VAT liability, payments, obligations and filing history from the dashboard, enabling better financial management and planning.

Real-Time Visibility

By using Magic Tax, businesses gain access to real-time visibility of their VAT obligations on the easy-to-navigate dashboard.

They can view VAT liability, payments, obligations and filing history from the dashboard, enabling better financial management and planning.

Cost Savings

With the potential for cost savings and reduced errors, Magic Tax allows Keyloop users to optimise the VAT processes and focus on core business activities.

The annual subscription starts from just £99 per submission* and will save you hours of manual manipulation of data or fees paid to accountants to perform the task for you.

Support

As a forward-thinking company, KFA Connect, developers of Magic Tax are also committed to providing first-class customer support.

We offer a dedicated support team that is available to assist you with any questions or issues.

Magic Tax also provides regular updates and improvements based on customer feedback, ensuring that the solution always keeps up with its user’s requirements

Free 3-Month Trial

With a Free 3-Month free trial you can use the solution to see for yourself how it will benefit your business.

The Free trial is valid for 3 months or when you have made a submission – whichever comes first.

There is no obligation to sign up for an annual licence once the free trial expires, and no payment information is taken during the free trial period.

The Magic Tax team are ready and willing to help streamline your MTD for VAT processes.

If you are interested in a demo of the solution?

Request one here:

Read more information about HMRC’s planned system downtime here.

If HMRC’s system is down, the Magic Tax solution will be too, as our solution relies on their system being operational.

Interested in KFA Connect?

Find out more about systems integration, bespoke software development, eCommerce Development & Integration, Business Process Automation and more…